As a seasoned short squeeze analyst, I’ve been tracking Profusa Inc. (NASDAQ: PFSA) since its Nasdaq debut on July 14, 2025. This commercial-stage digital health company, specializing in innovative tissue-integrated biosensors for continuous biochemistry monitoring, has quickly captured attention with its blend of cutting-edge AI-driven health tech and a forward-thinking Bitcoin treasury strategy. With shares trading around $0.55 as of August 13, 2025—up from a recent low of $0.49—the stock’s volatility and accumulating short activity suggest a classic setup for a potential short squeeze. Let’s dive into the data, catalysts, and why this could be a bullish opportunity for savvy investors.

Understanding the Short Data: Signs of Building Pressure

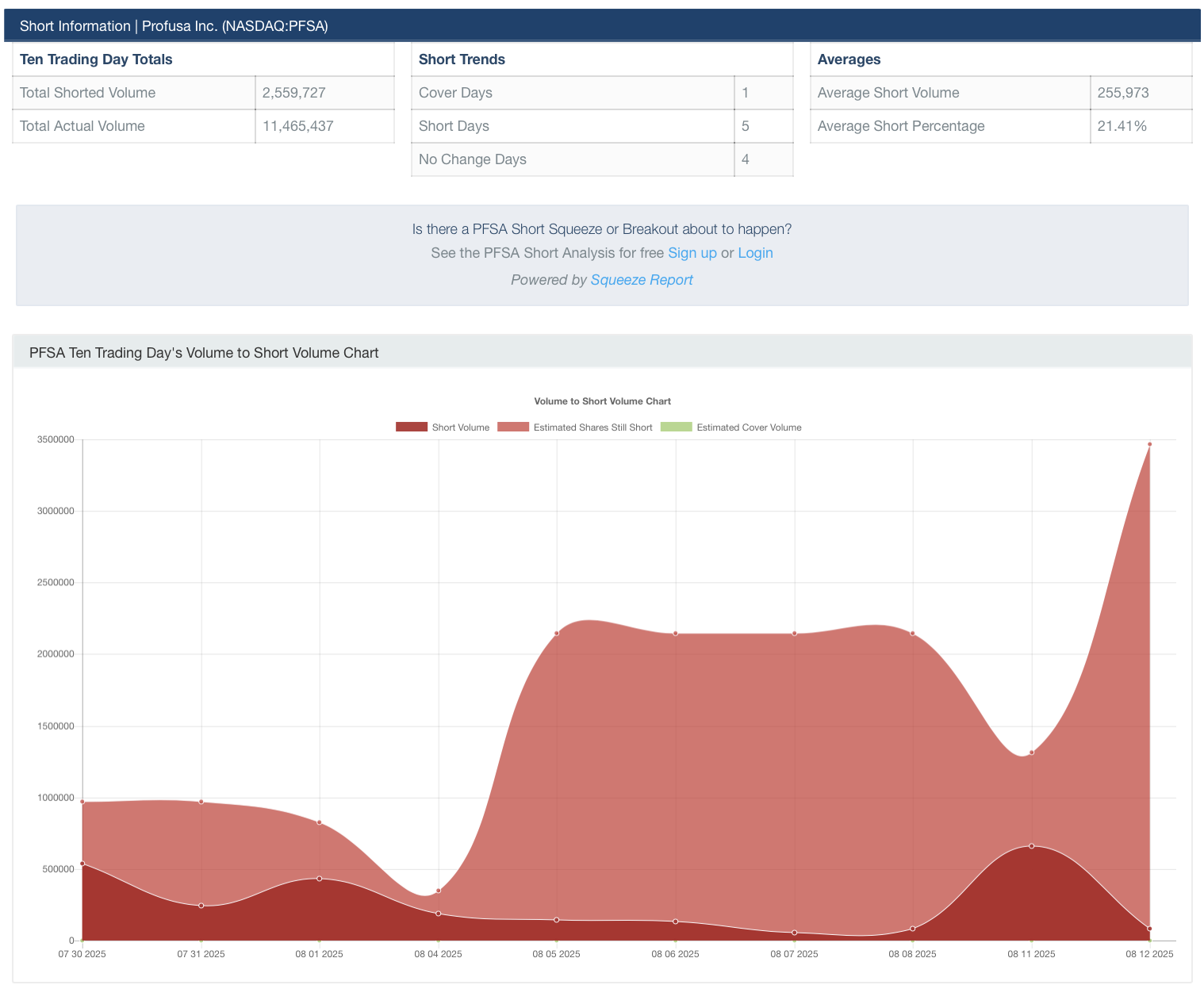

Recent short volume data for PFSA reveals a compelling picture of seller aggression amid declining prices. Over the last 10 trading days (from July 30 to August 12, 2025), the stock saw a total shorted volume of approximately 2.56 million shares out of 11.46 million total volume traded, equating to an average short percentage of 21.41%. Key highlights include:

- Peak Short Days: On August 4, shorts accounted for 34.23% of volume (188,741 short shares), coinciding with a price dip from $0.58 open to $0.5951 close—indicating heavy betting against the stock during a brief uptick. Similarly, August 11 saw 30.71% short volume (659,767 shares) as the stock hovered around $0.50.

- Trend Analysis: The data shows 5 “short days” (where shorts increased), 1 “cover day,” and 4 “no change days.” This imbalance points to persistent short positioning, potentially leaving sellers exposed if positive catalysts emerge.

- Chart Insights: The accompanying volume-to-short chart illustrates a hump in short activity mid-period, followed by a sharp rise in estimated shares still short toward August 12. With total shorted volume nearing half the company’s float (more on that below), any forced covering could ignite upward momentum.

Importantly, this daily short volume—while not the same as cumulative short interest—often precedes reported increases in short positions. As of July 15, 2025, FINRA data showed 180,000 shares sold short. Given the stock’s youth and the aggressive shorting since, I estimate current short interest could now represent 10-20% of the float, a level ripe for squeezes in microcap names like this.

Low Float and High Volatility: The Perfect Squeeze Ingredients

PFSA’s market structure amplifies its squeeze potential. The company has about 32.95 million shares outstanding, but the public float is a mere 5.17 million shares—tightly held with 16.93% by insiders and 1.16% by institutions. This low float means even moderate buying pressure can send shares soaring, especially if shorts (potentially holding 500,000+ shares based on recent volume) are forced to cover.

The stock’s price action supports this: After dipping to $0.47 on August 12, shares rebounded 14.87% intraday on August 13 amid news of a share offering filing, trading at $0.55 with volume exceeding 640,000 shares. Market cap sits at a modest $18 million, making PFSA an accessible play for retail traders who often fuel squeezes.

Catalysts Fueling the Bull Case

Profusa isn’t just a volatile penny stock—it’s backed by real innovation and strategic moves that could trigger a breakout:

- Bitcoin Treasury Strategy: In late July, PFSA announced a $100 million Equity Line of Credit (ELOC) to build a Bitcoin reserve, starting with a $1 million investment. This aligns the company with crypto’s upside, hedging against inflation while appealing to digital asset enthusiasts. If Bitcoin rallies (as it has historically post-halving), PFSA’s balance sheet strengthens, potentially drawing in more buyers.

- Clinical and Commercial Milestones: The August 6 strategy update outlined five growth pillars, including near-term revenue from research applications and a Q1 2026 European launch for the Lumee™ Oxygen platform, targeting a $10 billion market. Human validation data for its glucose monitoring platform (addressing 500 million+ patients) is imminent, with U.S. commercialization eyed for mid-2027. These advancements position PFSA at the forefront of personalized healthcare, a sector projected to boom.

- Social Buzz and Momentum: On X (formerly Twitter), sentiment is overwhelmingly positive, with posts highlighting PFSA’s “short squeeze opportunity,” “power surge,” and “go time” vibes. Influencers are touting the Bitcoin tie-in and low-float setup, with recent mentions like “up 13% today” and calls for bounces. This retail enthusiasm, combined with promotional videos on YouTube, could spark FOMO buying.

Recent news, including the strategy overview and a distribution deal in Spain, underscores execution strength. With no major red flags in filings and a visionary CEO in Ben Hwang, Ph.D., PFSA feels undervalued at current levels.

Positive Market Advice: Why Consider Going Long on PFSA

In my view, PFSA presents a high-reward setup for short squeeze hunters. The combination of elevated short activity, a tiny float, and upcoming catalysts mirrors past squeezes in low-float biotechs and crypto-adjacent plays. Days to cover could be low (based on average volume of ~1.15 million shares), meaning a surge in buying—perhaps from positive clinical data or Bitcoin’s rise—could force rapid covering and send shares toward $1+ in short order.

Investment Recommendation: Accumulate shares on dips below $0.50, targeting $0.80-$1.00 in the near term. Set stops at $0.45 to manage risk, and monitor volume for breakout signals above 2 million shares daily. This isn’t financial advice—do your due diligence—but with the stock’s momentum building, PFSA could deliver explosive returns for those positioned early.

IMPORTANT DISCLAIMER NOTICE: The owner and contributors are NOT registered as Investment Advisers in any form at all. Readers should verify all claims and content from Squeeze Report or affiliates. We encourage proper due diligence on any security mentioned. Likewise, note that by presenting a solicitation for a page on our site, or by pursuing any Squeeze Report content you are unequivocally consenting to have read, comprehended, and consented to the entirety of the terms set out by this disclaimer. This disclaimer is provided because we are in the business of publishing advertisements and disseminating information on high risk stocks. Therefore, certain communication disclosures must be made to viewers. The companies are commonly referred to as “high risk stocks”. These “penny stock” securities are known to have high risk and speculative nature on the market. Squeeze Report provides all buy, sell, or holding period disclosures on any profiled issuer. Squeeze Report engages in sharing, re-posting and advertising our sponsored clients public material. Squeeze Report does not hold any position in the mentioned companies above. We have been compensated six thousand dollars for this communication from non affiliated 3rd party for multi-day advertising program from 2025-08-13 to 2025-08-15 . Squeeze Report, managers, and site contributors are not registered investment advisors in any form. Squeeze Report is not responsible for maintaining the accuracy, integrity, and relevancy of third-party source data used in profiles. None of our information provided is a solicitation to buy or sell PFSA or any security profiled by Squeeze Report. Our content is strictly for informational purposes only. This information is not intended and should not be used to make any investment decisions. We advise viewers to consult with a registered investment advisor prior to making any investment decisions. You are fully aware that you will lose your entire investment in any stocks mentioned. You can view our privacy policy and risk disclaimer here.