Introduction

In early 2021, GameStop (GME) shocked Wall Street by skyrocketing from under $20 to nearly $500 per share in a matter of weeks, fueled by retail investors triggering one of the largest short squeezes in market history. Fast forward to 2025, a new candidate for an even more dramatic squeeze is emerging: VisionWave Holdings Inc. (NASDAQ: VWAV).

A recent third-party report by Squeeze Report indicates extraordinary levels of short selling activity that, if accurate, could make GameStop’s squeeze look small in comparison. This analysis examines the report’s findings, assesses their credibility, and models the potential price impact relative to GameStop’s historic run.

1. The Squeeze Report Findings

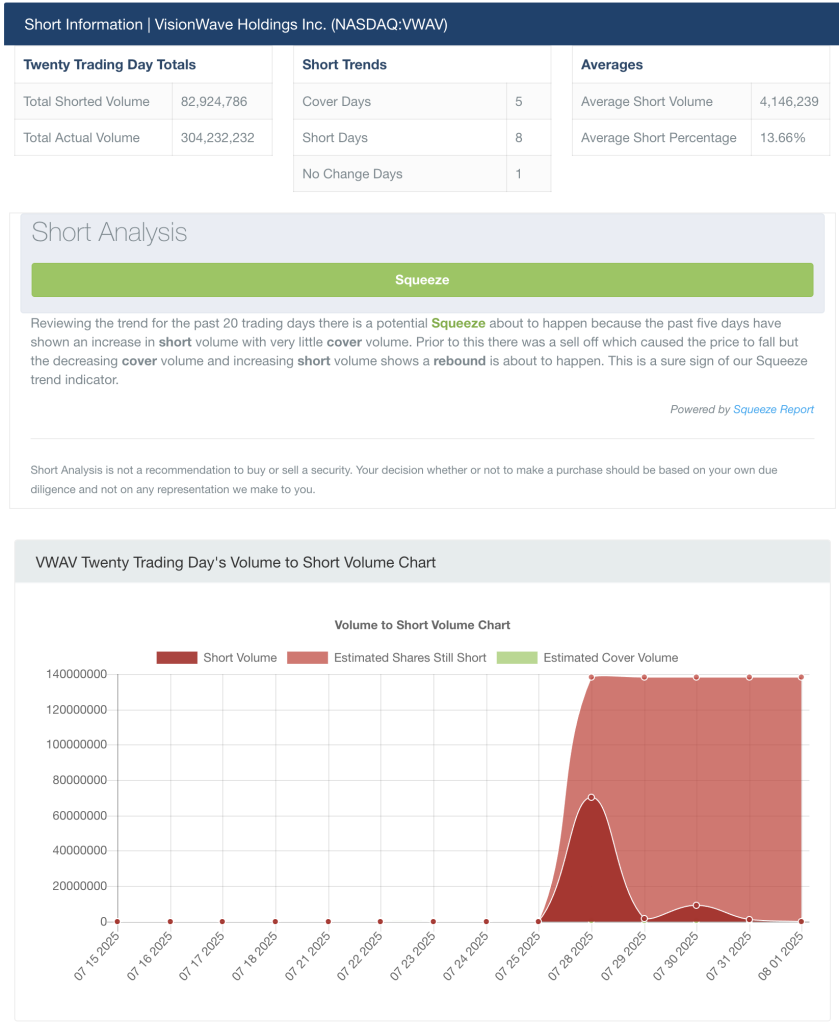

According to Squeeze Report’s data:

- Total Shorted Volume (20 days): 82.9 million shares

- Total Trading Volume (20 days): 304 million shares

- Average Daily Short Percentage: 13.66%

- Covering Activity: Minimal; most short positions remain open.

Key Signal

- Over the past 20 trading days, VWAV’s short volume exceeded 75 times its estimated public float (1.1–1.4M shares).

- The algorithm labels VWAV a “High Probability Short Squeeze Candidate” due to:

- Sustained heavy shorting.

- Lack of meaningful covering.

- Extremely tight float.

2. Understanding the Float and Liquidity Constraints

VWAV has:

- Shares Outstanding: ~14.2M

- Public Float: ~1.1–1.4M shares

With such a small float, every share traded multiple times daily magnifies price swings. Covering tens of millions of short positions would require buying back shares far exceeding what’s actually available, a classic setup for a violent squeeze.

3. How This Compares to GameStop

- GameStop (2021):

- Float: ~70M shares

- Short interest: ~90M shares (140% of float)

- Price spike: ~$17 → ~$500 intraday (~30×).

- VisionWave (2025):

- Float: ~1.1M shares (≈60× smaller than GME).

- Recent short volume: 82M shares (~7,000% of float).

- Hypothetical open short: Even if 20% of shorts (16M shares) remain open, this equals 14.5× the float—dwarfing GameStop’s ratio.

Why VWAV Could Surpass GameStop

- Micro float means less supply to absorb buying pressure.

- Short positions already exceed any historical ratio seen in GME.

- Forced covering could trigger exponential price increases in hours, not weeks.

4. Projected Price Dynamics

Based on modeling:

- 20% Shorts Cover: ~$23/share

- 50% Shorts Cover: ~$58/share

- 100% Shorts Cover: ~$116/share

- Speculative Buying Multiplier (2–4×): Price could spike to $200–$400+.

Market Cap Impact

- At $400/share, VWAV’s market cap would be:

2.2M \text{ shares} \times 400 = 880M

- Still far below mega-cap levels, meaning room to run without approaching trillion-dollar valuations.

5. Why FINRA Short Interest Data May Understate Reality

- Official short interest reports (updated twice monthly) show just ~1% of float shorted.

- These reports lag by weeks and only count open shorts, not massive intraday shorting.

- Market makers can use synthetic shorting tactics not immediately visible in reports.

- This explains why daily short volume can be massive while official numbers remain low.

6. Potential Outcomes

- Bullish Scenario: Shorts begin covering amid upward price action, triggering margin calls and a self-reinforcing squeeze.

- Extreme Scenario: Coordinated buying from retail and institutions pushes VWAV into multi-hundred-dollar territory, eclipsing GameStop’s proportional squeeze.

- Risk Factors: Nasdaq could halt trading multiple times, borrow rates could spike, and liquidity constraints could create chaotic price action.

Conclusion

If Squeeze Report’s findings are accurate, VWAV faces one of the most asymmetric setups in market history. A float of just over 1M shares combined with tens of millions shorted makes covering positions mathematically challenging without triggering a parabolic move.

GameStop’s legendary 2021 squeeze, while historic, might ultimately be remembered as a “small potato” compared to what could unfold with VisionWave Holdings.

The coming weeks will reveal whether these signals translate into market action—or if they remain a theoretical warning of Wall Street’s next big squeeze.

IMPORTANT DISCLAIMER NOTICE: The owner and contributors are NOT registered as Investment Advisers in any form at all. Readers should verify all claims and content from Squeeze Report or affiliates. We encourage proper due diligence on any security mentioned. Likewise, note that by presenting a solicitation for a page on our site, or by pursuing any Squeeze Report content you are unequivocally consenting to have read, comprehended, and consented to the entirety of the terms set out by this disclaimer. This disclaimer is provided because we are in the business of publishing advertisements and disseminating information on high risk stocks. Therefore, certain communication disclosures must be made to viewers. The companies are commonly referred to as “high risk stocks”. These “penny stock” securities are known to have high risk and speculative nature on the market. Squeeze Report provides all buy, sell, or holding period disclosures on any profiled issuer. Squeeze Report engages in sharing, re-posting and advertising our sponsored clients public material. Squeeze Report does not hold any position in the mentioned companies above. We have been compensated three thousand dollars for this communication from non affiliated third party for multi-day advertising program from 2025-08-02 to 2025-08-08 . Squeeze Report, managers, and site contributors are not registered investment advisors in any form. Squeeze Report is not responsible for maintaining the accuracy, integrity, and relevancy of third-party source data used in profiles. None of our information provided is a solicitation to buy or sell VWAV or any security profiled by Squeeze Report. Our content is strictly for informational purposes only. This information is not intended and should not be used to make any investment decisions. We advise viewers to consult with a registered investment advisor prior to making any investment decisions. You are fully aware that you will lose your entire investment in any stocks mentioned. You can view our privacy policy and risk disclaimer here.